401k Max Contribution 2025 Employer Matching

401k Max Contribution 2025 Employer Matching. If you're age 50 or older, you're. The maximum you can contribute to your 401(k) in 2025 is $23,000 if you're under age 50, or $23,500 in 2025.

If you’re age 50 or older, you’re. Employers may opt for a safe harbor 401(k) plans to simplify administration and ensure compliance with nondiscrimination testing.

Maximum 401k Employer Match 2025 Willi Genovera, The maximum is $30,500 in 2025 or $31,000 in 2025 if you're age 50 or older.

matching example_ Boeing.png?width=4960&name=401(k) matching example_ Boeing.png)

What Is The Maximum 401k Contribution For 2025 Including Employer Match, Employer matching is a key job.

Max 401k Contribution 2025 Employer Match Salli Consuela, Participants who are 50+ can save an additional $7,500 in 2025 in.

Max 401k Total Contribution 2025 Myrle Vallie, Employer 401(k) matching doesn't apply toward the 401(k) contribution limit, but there is a higher limit to watch our for.

What Is My Maximum 401k Contribution For 2025 Jilly Lurlene, The limit set by the internal revenue service for total 401(k) contributions for 2025 from.

Max 401k Contribution 2025 Employer Match Tedra Vivian, In 2025, the 401(k) contribution limit for participants is increasing to $23,000, up from $22,500 in 2025.

Maximum Employer 401k Match 2025 Ambur Myrtle, Employers match 401(k) contributions by offering a matching contribution based on a specific percentage of the employee's contributions or their salary up to a.

Max 401k Contribution 2025 Employer Match Alli Luella, The maximum you can contribute to your 401(k) in 2025 is $23,000 if you're under age 50, or $23,500 in 2025.

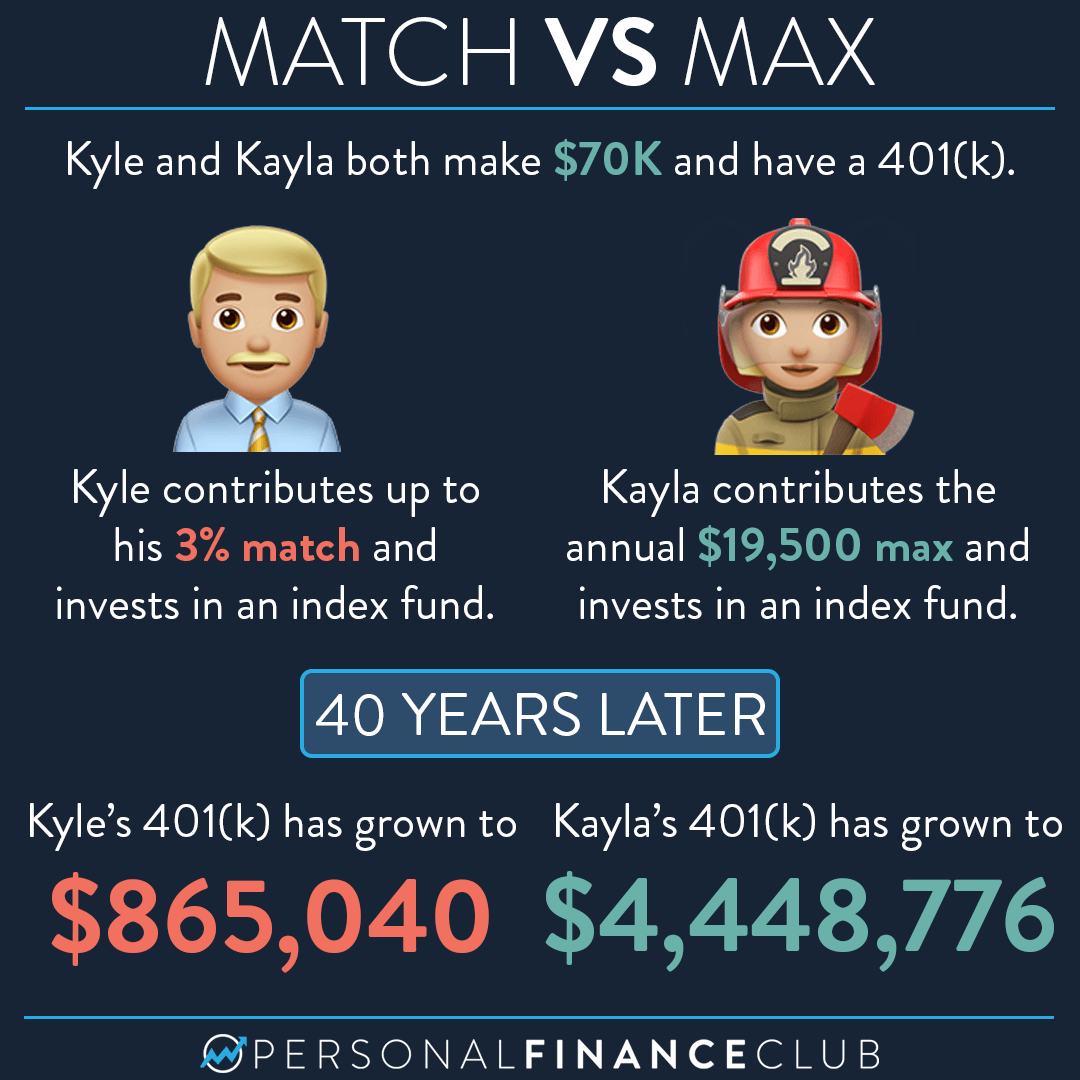

Max 401k Contribution 2025 And Catch Up Dollie Leland, By setting your annual contribution to the ceiling of your employer’s matching contribution, as shown in our examples, your annual contribution becomes 50% to 80% larger than if you had only your individual.

Max 401k Contribution 2025 Employer Match Dyanna Devonne, The 401(k) contribution limit for 2025 is $22,500 for employee salary deferrals and $66,000 for combined employee and employer contributions.